The

Wilshire 5000 from 2000 until Mar 30, 2007

The

Dow Jones Wilshire 5000 Composite Index, more simply

the Dow Jones Wilshire 5000, is a market capitalization-weighted

index of the market value of all stocks actively traded

in the USA.

Specifics

The index

is intended to measure the performance of all publicly traded

companies based in the United States having "readily available

price data." Hence the index includes nearly all common stocks, REITs, and limited partnership shares traded

primarily on the New York Stock Exchange, NASDAQ, or American Stock Exchange.

The price

of each issue included in the index is weighted by its relative

market capitalization. Let:

- M

= Number of issues included in the index;

- Pi

= Price of one share of issue i included in the index;

- Ni

= Number of shares of issue i.

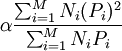

- α

= a fixed scaling factor

The index

is then calculated as:

One index point corresponds to about US$1 billion. Hence the value

of the index, multiplied by one billion dollars, roughly equals

the total capitalization of the US stock market. Dow Jones publishes

two versions of the index, one based on full market capitalization

and another based on a float-adjusted market capitalization,

reflecting the number of shares actually available to trade.

The list of

issues is updated monthly to add new listings resulting from corporate

spin-offs and initial public offerings, and to remove issues which

move to the pink sheets or stop trading for ten days or more.

History

Wilshire Associates

began the index in 1974, naming it for the approximate number

of issues it included at the time. It was renamed the "Dow Jones

Wilshire 5000" in April 2004, after Dow Jones & Company assumed

responsibility for its calculation and maintenance.

The Wilshire

5000 did not close above its March 24, 2000 peak until February

20, 2007. A hypothetical investment in the Wilshire 5000, made

at the 2000 peak and with subsequent dividends reinvested, did

not become profitable on a closing basis until October 3, 2006.[1] On April 20, 2007, the index closed above 15,000 for the

first time. On that day, the S&P 500 was still several

percentage points below its March 2000 high. Since the turn of

the millennium, small cap issues absent from the S&P500 and

included in the Wilshire 5000 have slightly outperformed the large

cap issues that dominate the S&P 500.

External

links

|