|

The Nasdaq Composite is a stock market index of all

of the common stocks and similar securities (e.g. ADRs,

tracking stocks, limited partnership interests) listed on

the NASDAQ stock market, meaning that it has over 3,000

components. It is highly followed in the U.S. as an indicator

of the performance of stocks of technology companies and

growth companies.

Since

both U.S. and non-U.S. companies are listed on the NASDAQ

stock market, the index is not an exclusively U.S. index.

|

|

|

History

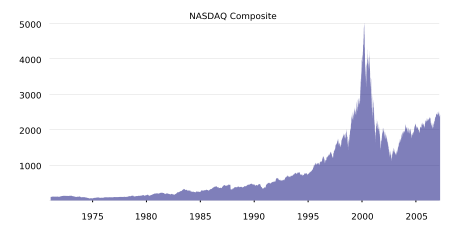

The NASDAQ

Composite from 1971 until today

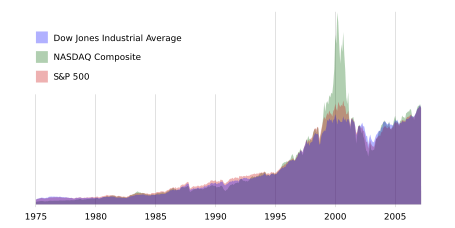

The NASDAQ

composite, shown here in green, has had larger swings than

other indices. Since the NASDAQ is heavy in tech companies,

the dot-com bust devastated it.

Launched in

1971 with a base value of 100 points, the Nasdaq Composite Index

is a broad based index which is calculated under a market capitalization

weighted methodology. To be eligible for inclusion in the Composite,

a security's U.S. listing must be exclusively on the NASDAQ Stock

Market (unless the security was dually listed on another U.S.

market prior to 2004 and has continuously maintained such listing),

and have a security type of either:

- American

Depositary Receipts (ADRs)

- Common

Stock

- Limited

Partnership Interests

- Ordinary

Shares

- Real Estate

Investment Trusts (REITs)

- Shares

of Beneficial Interest (SBIs)

- Tracking

Stocks

Closed-end

funds, convertible debentures, exchange traded funds, preferred

stocks, rights, warrants, units and other derivative securities

are not included. If at any time a component security no longer

meets the above criteria, the security becomes ineligible for

inclusion in the Composite Index and is removed.

On July 17,

1995, the index closed above the 1,000 mark for the first time.

The all-time low for the index had been reached in October 1974

around 54 points, representing a market drop of more than 45%

from the time of its introduction. On March 10, 2000, the index

peaked at an intra-day high of 5,132.52, and closed at an all-time

high of 5,046; the decline from this peak signaled the beginning

of the end of the dot-com stock market bubble. The index declined

to half its value within a year, and finally found a bear market

bottom on October 10, 2002 with an intra-day low of 1,108.49 after

a close of 1,114 the previous day. While the index gradually recovered

since then, it did not trade for more than half of its peak value

until May 2007. The index opened the fourth quarter of 2007 with

new 80-month highs, closing above the 2,800 point mark on October

9, 2007. The intraday level of 2,861.51 on October 31, 2007 was

the highest point reached on the index since January 24, 2001.

While increased anxiety over high energy prices and the possibility

of recession dropped the NASDAQ well into correction territory

in early 2008, a bear market was finally recognized on February

6th, 2008 when the NASDAQ closed below the 2,300 level, about

20% below the recent highs.

References

External

links

|