In finance, a forex swap (or FX swap) is an over-the-counter short term interest rate derivative instrument. In emerging money markets, forex swaps are usually the first derivative instrument to be traded, ahead of forward rate agreements.

Structure

A forex swap consists of two legs:

- a spot foreign exchange transaction, and

- a forward foreign exchange transaction.

These two legs are executed simultaneously for the same quantity, and therefore offset each other.

Uses

Forex swaps are used for hedging currency positions and for speculation.

Hedging

Investors use forex swaps to hedge their existing forex exposures by swapping temporary surplus funds in one currency into another currency for better use of liquidity. Doing so protects against adverse movements in the forex rate, but favourable moves are renounced.

Speculation

Investors use forex swaps to speculate on changes in the interest rate differentials between two currencies.

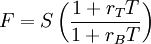

The relationship between spot and forward is as follows:

where:

- F = forward

- S = spot

- rT = interest rate of the term currency

- rB = interest rate of the base currency

- T = tenor (calculated according to the appropriate day count convention)

The forward points or swap points are quoted as the difference between forward and spot, F - S, and is expressed as the following:

where rT and rB are small. Thus, the absolute value of the swap points increases when the interest rate differential gets larger, and vice versa.

Related instruments

A forex swap should not be confused with a currency swap, which is a much rarer, long term transaction, governed by a slightly different set of rules.